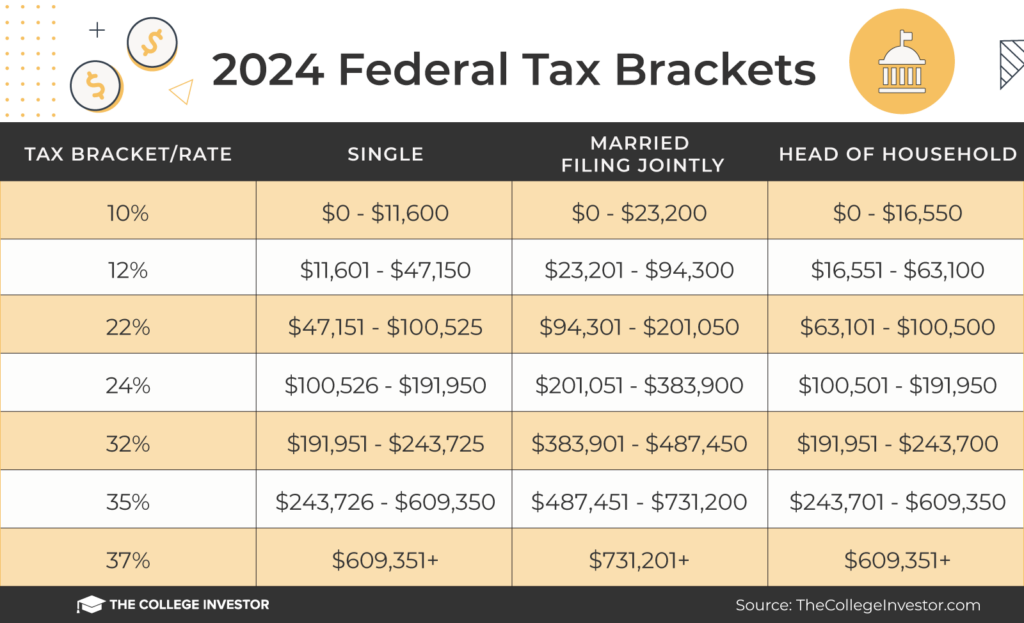

2025 Income Tax Brackets Federal. The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. There are seven (7) tax rates in 2025.

The highest earners fall into the 37% range, while those who earn the least are in the 10%. Due to inflation, these brackets were adjusted significantly from. The federal tax rate for 2025, filed in 2025, has been adjusted to reflect changes in the economy.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2025 tax time guide series to.

Federal Withholding Tables 2025 Federal Tax, This page has the latest federal brackets and tax rates, plus a federal income tax calculator.

Tax Rates 2025 To 2025 2025 Printable Calendar, Federal 2025 income tax ranges from 10% to 37%.

Tax Brackets for 2025 and 2025 Publications National, Due to inflation, these brackets were adjusted significantly from.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, See current federal tax brackets and rates based on your income and filing status.

Oct 19 IRS Here are the new tax brackets for 2025, Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2025 tax time guide series to.

Tax filers can keep more money in 2025 as IRS shifts brackets The Hill, 2025 federal tax income brackets.

2025 tax brackets IRS inflation adjustments to boost paychecks, lower, However, there will be some other changes to federal taxes for the 2025 tax year, which.

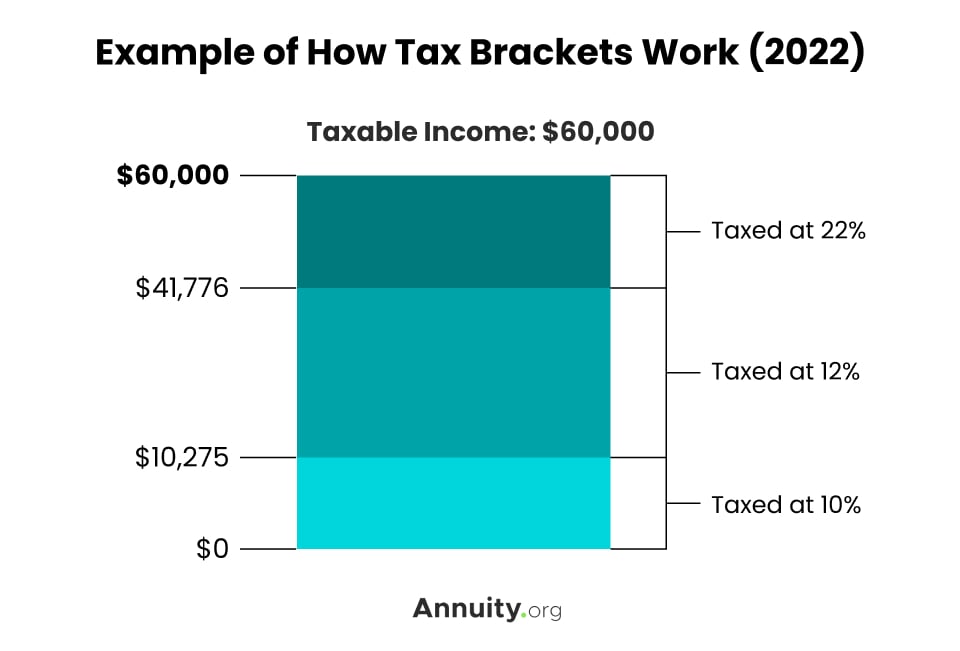

The income limits for all 2025 tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Federal income tax system is progressive, meaning income is taxed in layers, with a higher tax rate applied to each layer.